The Revenue Act of 1862

On July 1, 1862, President Abraham Lincoln signed the Revenue Act of 1862 into law, to help fund the Civil War. Revenue stamps remained in use off an on for a century, paying the tax on a wide variety of items.

On July 1, 1862, President Abraham Lincoln signed the Revenue Act of 1862 into law, to help fund the Civil War. Revenue stamps remained in use off an on for a century, paying the tax on a wide variety of items.

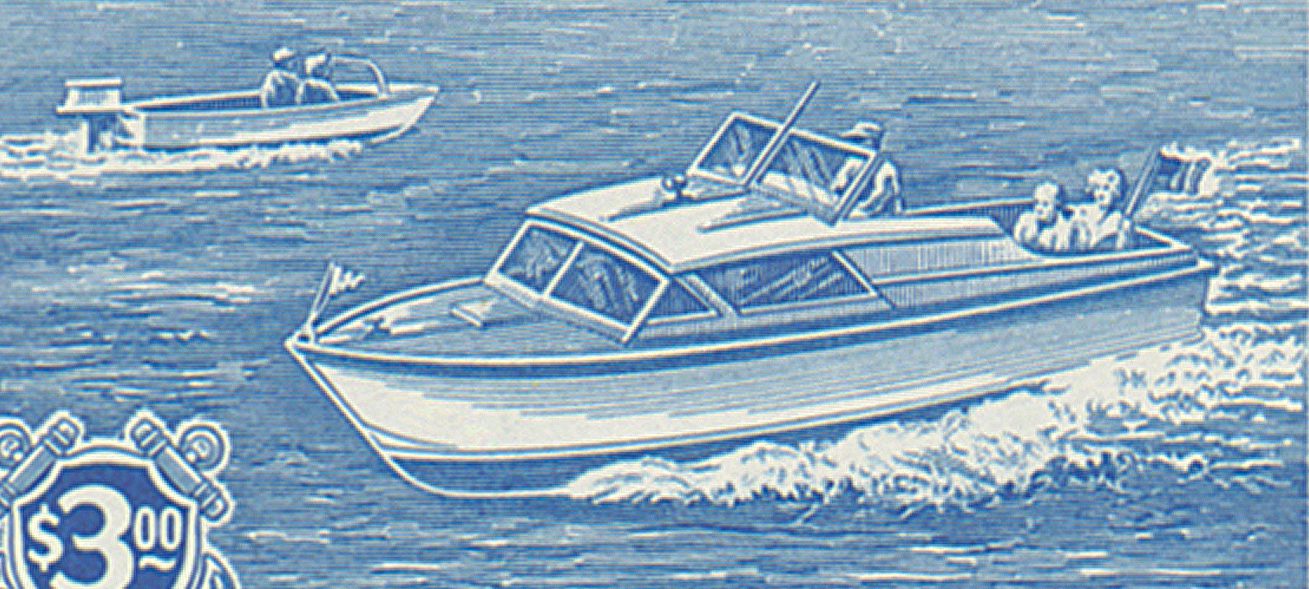

On April 1, 1960, the US issued two boat stamps for use on motorboat applications. The stamps were part of an effort to promote boating safety in collaboration with the Coast Guard.

On February 25, 1919, a Narcotic Tax was officially instated. Initially created to help fund World War I, they remained in use for over 50 years.

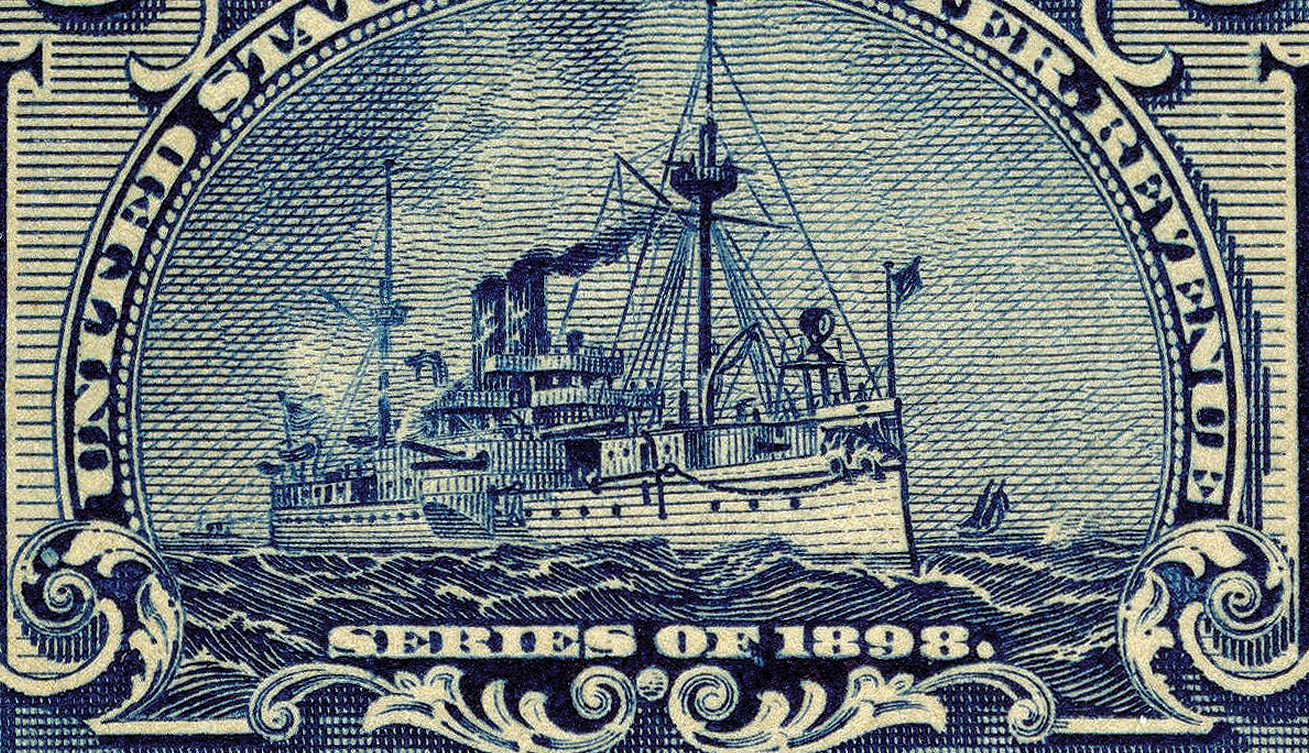

On February 15, 1898, the USS Maine mysteriously exploded in Havana Harbor, leading the US to declare war on Spain two months later. Special Revenue stamps depicting the Maine were produced to fund the Spanish-American War and the event had a significant impact on US postage stamps.

In response to Parliament’s Stamp Act of 1765, American colonists assembled in New York City on October 7 to organize a unified protest. The Stamp Act Congress is often considered one of the first organized political actions of the American Revolution.

On September 2, 1871, the first Proprietary stamps with their own Scott designation (RB) were issued. These stamps paid the taxes on consumer goods, such as medicines, matches, perfumes, playing cards, canned foods, and more.

On September 1, 1866, the first US Beer stamps were issued. The first stamps issued for use on alcoholic beverages, they remained in use until 1951.

On August 24, 1935, President Franklin D. Roosevelt signed the Potato Control Law, which led to the creation of short-lived Potato stamps.

On June 25, 1918, Stock Transfer stamps were approved for use. These stamps showed that the taxes had been paid on the sale or transfer of shares or certificates of stock.